universal life insurance face amount

The face value or face amount of a life insurance policy is established when the policy is issued. Policy Change Request Type.

Life Insurance Policy Loans Tax Rules And Risks

The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

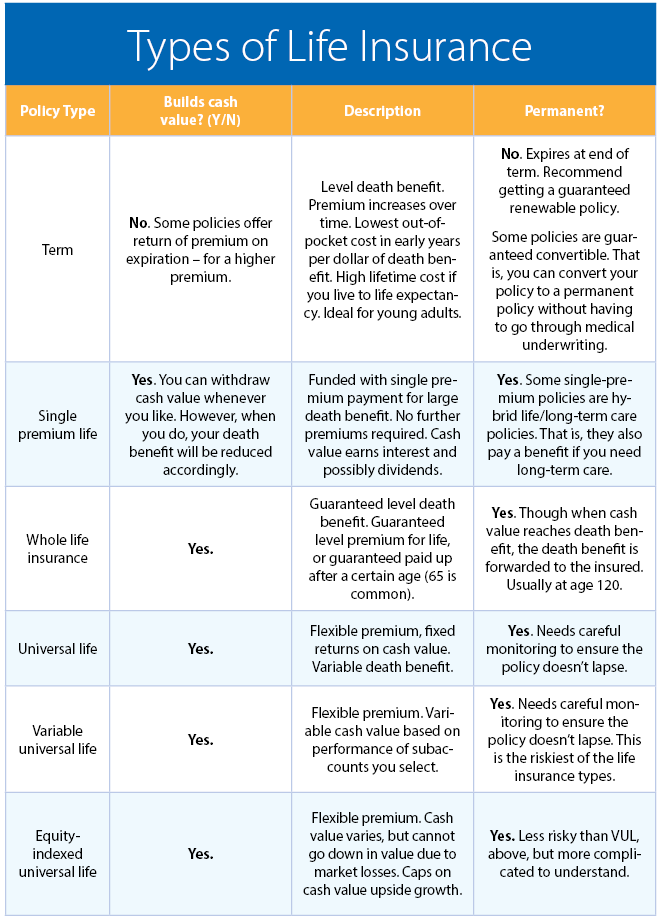

. Universal Life Insurance A universal life insurance policy allows the change of the face amount and the premium amount. This Policy Change content is for Term Life products issued between 2013 to 2017. Only permanent life insurance policies such as whole life and universal life.

Universal Life Insurance UL Universal life insurance lets you make two choices which are as follows. Ad With Universal Life Insurance You Can Make Changes to Your Policy As Desired. Ad Help Keep Your Plans For Retirement On Track With A Level Of Protection.

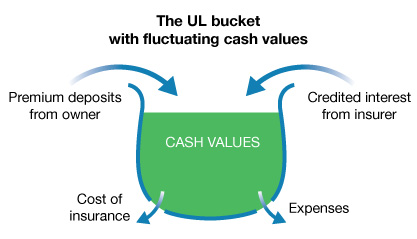

Universal life insurance is a type of permanent life insurance. Shield Level Annuities Can Help You Focus On Your Plans For Retirement. The amount of money that has accumulated is known as the cash value of the whole life policy.

This is often far more easily accomplished. Under the terms of the policy the excess of premium payments above the. Face Amount is the amount of life insurance that a policy owner purchases.

Universal Life Insurance Explained the Different Factors When Comparing Life Policies. Variable Universal Life Insurance - VUL. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force.

The actual death benefit paid on a death claim could differ from the face amount due to death. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. The Most Reliable Universal Life Insurance Companies Thatll Actually Cover Your Expenses.

Ad Shop The Best Rates From National Providers. Universal life insurance allows policy owners to rather easily make adjustments to the death benefit or face amount of their policies. SelectQuote Rated 1 Term Life Sales Agency.

Ad Get Instantly Matched with Your Ideal Universal Life Insurance Plan. It allows for a greater degree of flexibility and often lower cost than whole life insurance another. So if you buy a policy with a 500000 face value in most.

Variable universal life insurance VUL is a form of cash-value life insurance that offers both a death benefit and an investment feature. Normally the face amount is a round number like. Universal Life Insurance Explained the Different Factors When Comparing Life Policies.

Level Death Benefit Beneficiaries will only get the face. Ad With Universal Life Insurance You Can Make Changes to Your Policy As Desired. One Year Term OYT Guaranteed Level Term GLT 10 15 20 30.

For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. If you have a universal life policy and it has a cash surrender value then you are only insured for the difference between the cash value and the 50000 face amount. Key Factors to Consider When Making Changes.

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Difference Between Cash Value And Face Value In Life Insurance

Life Insurance Policy Loans Tax Rules And Risks

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

Understanding Universal Life Insurance Forbes Advisor

Cash Value And Cash Surrender Value Explained Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance For Children A Look At The 4 Best Policies

Review Of Universal Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Cash Value And Cash Surrender Value Explained Life Insurance

Division Of Financial Regulation Universal Life Premium Life Insurance And Annuities State Of Oregon

What Are Paid Up Additions Pua In Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Life Insurance Loans A Risky Way To Bank On Yourself

Understanding Life Insurance What Policy Type Is Best For You